Our company name has changed from Finalto International Ltd to Markets International Ltd.

What's staying the same?

There are no changes to your experience

If you have any questions, our support team is here to help via phone, Live Chat or email support@markets.com

You are attempting to access a website operated by an entity not regulated in the EU. Products and services on this website do not comply with EU laws or ESMA investor-protection standards.

As an EU resident, you cannot proceed to the offshore website.

Please continue on the EU-regulated website to ensure full regulatory protection.

Thursday Sep 7 2023 11:41

9 min

Stock markets slipped across Europe again early on Thursday, with the FTSE 100 heading for a fourth straight day of losses as yet the irresistible force of stronger US services data (implying higher for longer rates) ran into rather more movable object of more soft China data (implying a weaker growth outlook). Combined we saw US stock markets reverse yesterday with the Nasdaq composite down more than 1% as several of the megacap names being hit. Apple and Nvidia both declined more than 3%, whilst Alphabet, Tesla and Amazon all fell more than 1%. The S&P 500 slid 0.7% and bounced off the 38.2/61.8% Fib level of the Jul-Aug decline at 4,442. Futures indicate a lower open later on Wall Street.

Shares in London, Frankfurt and Paris extended their weekly losses, dipping around 0.3-0.4% in early trade. Asian shares were sharply lower overnight with the major mainland China indices and the Hang Seng down over 1%. China’s manufacturing sector remains under the cosh with exports down 8.8% year-on-year and imports falling by 7.3%. The soft data weighed on risk and also sent crude down overnight after futures (WTI- Oct) had just squeezed out a fresh high north of $88 yesterday evening, whilst Brent holds $90, about $1 off its earlier peak.

US ISM – stronger than expected services report, lifted front end rates quite a bit with the 2yr jumping to 5.033% from a sub-5% level before the release. Sticky services inflation is really what worries the Fed more than an oil price jump and so the market paid a lot of attention to the fact that the Prices Index was up 2.1 percentage points in August, to 58.9 percent. The move nixed the earlier rally in the euro after ECB Governing Council member Knot had said the market was underestimating the chance for the ECB to hike next week, pushing EURUSD to gap down to its weakest in three months on the release of the US data. Sterling also slipped, weighed down also by some relatively dovish remarks from Bank of England governor Andrew Bailey.

Bailey said that we are “much nearer the top of the cycle on the basis of current evidence”, suggesting that, well, the Bank is near the top...this is not news as such, but the market always reads a lot into it. 2-year and 10-year gilt yields fell to their lows of the day after his comments to parliament's Treasury Committee. We know they think they are near the top and hopefully they are – does it suggest much about whether the MPC votes to hike this month? Not really; they’ll make that call on the day and it’s a fine one to call.

GBPUSD took a fresh leg lower this morning in the wake of those comments

EURUSD also trades near yesterday’s 3-month low as German data again disappointed – industrial production down 0.8% in July following the revised 1.4% decline in June.

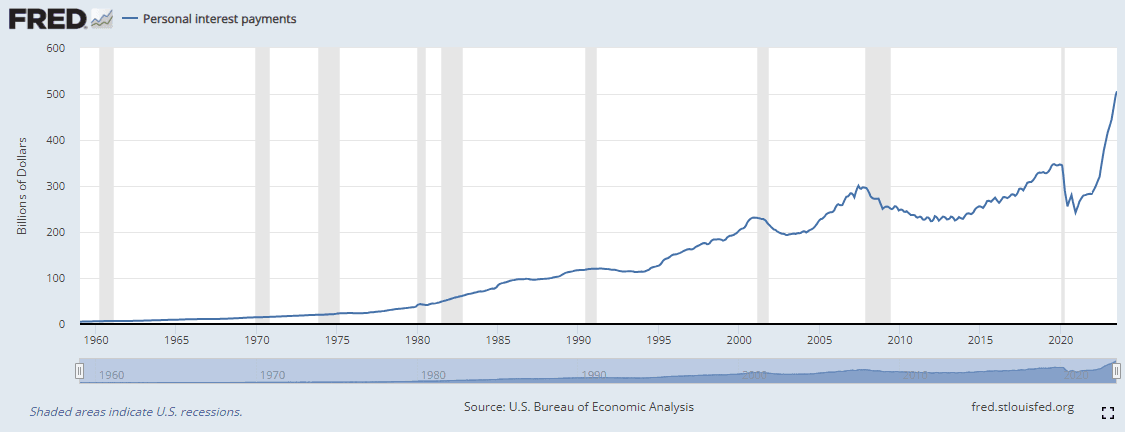

Otherwise getting a handle of the economic outlook is difficult. In the US, credit card and car loan defaults have hit a 10-year high, whilst corporate bankruptcies are also soaring. Student loan repayments are resuming Oct and personal interest payments are ballooning. It’s time, you think, for those long and variable lags to catch up with the American consumer. As for the market…well Vanguard notes value/growth ratio is an at extreme similar to 2020 and late 90s, whilst the yield on cash (3-month T-bill) exceeds the S&P 500 yield – first time since 2000 and often a signal for a market top. To get a sense for just how stretched and reliant on tech the market is , the last time the Nasdaq 100 and Russell 2000 traded so wide was in 2000 at the peak of the dotcom bubble.

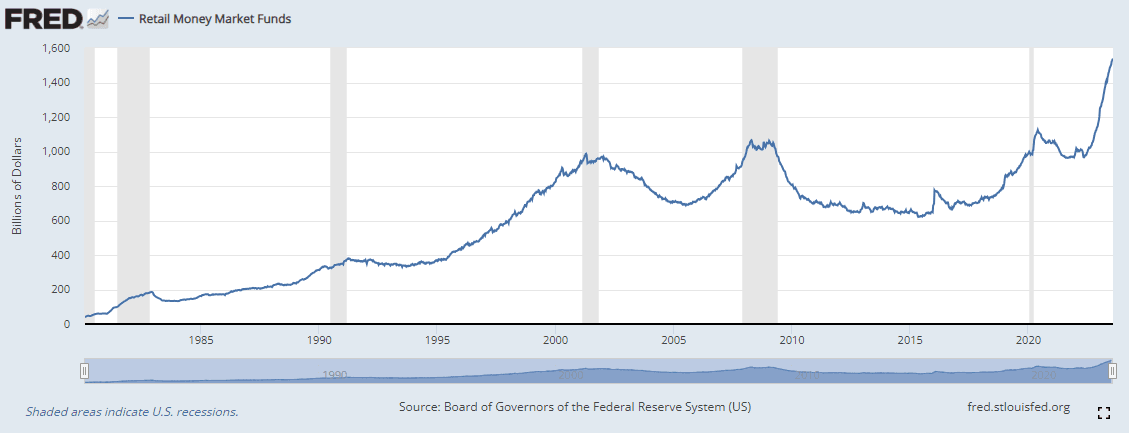

Retail is pouring cash into money market funds like they do just before every recession.

Personal interest payments: I’m sure it’s nothing.

Time to pause: After the RBA paused the Bank of Canada also decided it was time to hold steady at 5% following some softer GDP figures last week. Does this portend what is to come from the triumvirate of the Fed, ECB and BoE this month? Whilst the Fed is almost certainly going to stand pat on rates, it’s a much closer call for the other two. Meanwhile, as far as the Bank of Japan goes, policymaker Junko Nakagawa said they must maintain ultra-loose monetary policy for the time being.

Oil prices pulled back on the softer China data – bear in mind it is the world’s largest importer of crude...though anecdotal evidence suggests refinery runs and demand remain strong and ‘decoupled’ from economic data (h/t Energy Aspects). API data showed US inventories fell for a fourth straight week, down 5.5m barrels last week, indicating still strong demand in the US. Meanwhile Saudi Arabia has raised its October light crude selling prices to Asia and the US.

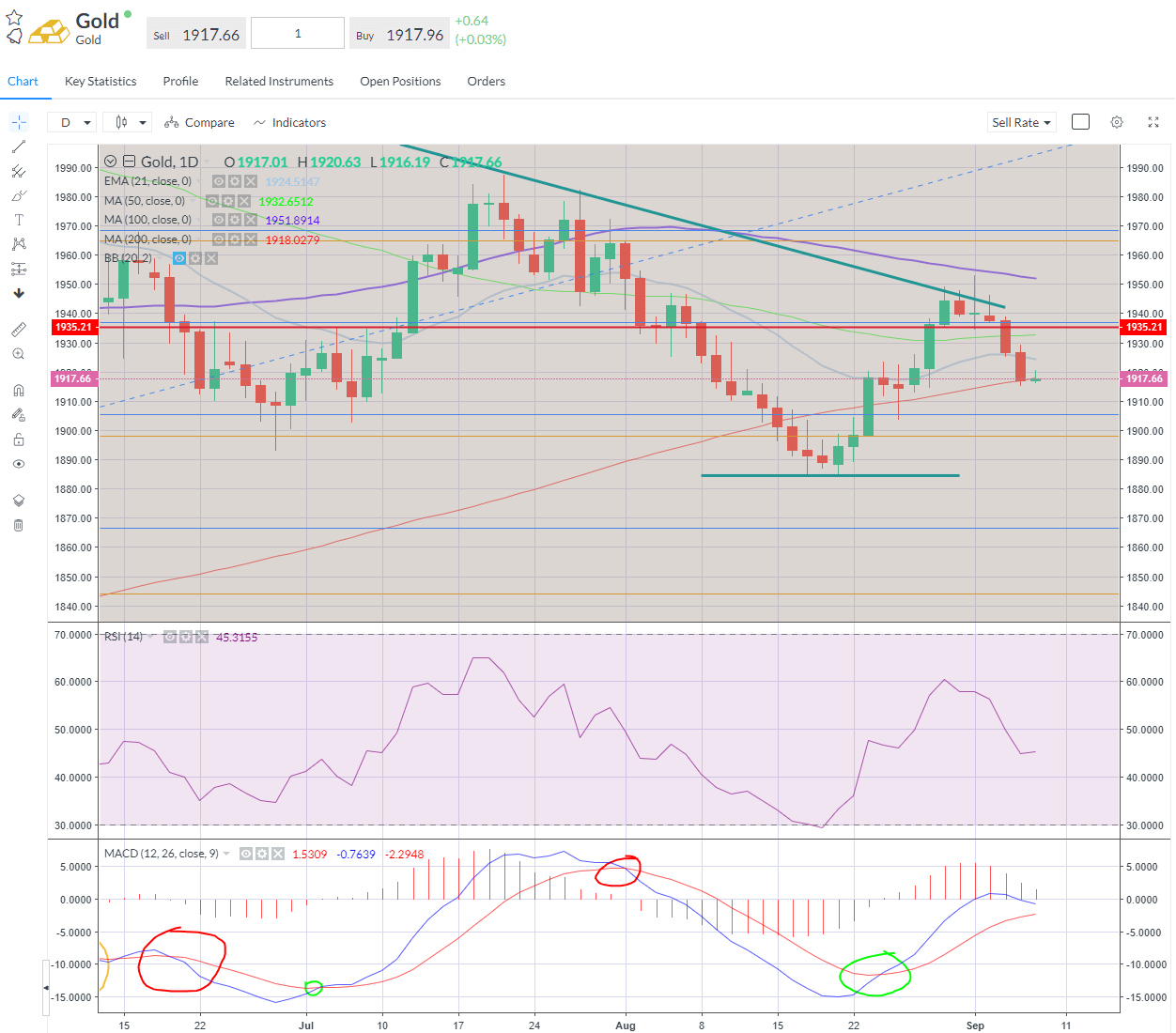

On the higher oil price + inflation -US gas prices have hit their highest level in summer in over a decade. I read in one esteemed paper a nonsensical suggestion, from one of the chancellor’s advisors, to impose a ‘tax on inflation’. Nuts. Finally, Gold – 200-day cracked with real rates soaring – 10yr TIPS are a whisker away from 2%, at or very near to its highest in 15 years.

Risk Warning and Disclaimer: This article represents only the author’s views and is for reference only. It does not constitute investment advice or financial guidance, nor does it represent the stance of the Markets.com platform. Trading Contracts for Difference (CFDs) involves high leverage and significant risks. Before making any trading decisions, we recommend consulting a professional financial advisor to assess your financial situation and risk tolerance. Any trading decisions based on this article are at your own risk.