Our company name has changed from Finalto International Ltd to Markets International Ltd.

What's staying the same?

There are no changes to your experience

If you have any questions, our support team is here to help via phone, Live Chat or email support@markets.com

You are attempting to access a website operated by an entity not regulated in the EU. Products and services on this website do not comply with EU laws or ESMA investor-protection standards.

As an EU resident, you cannot proceed to the offshore website.

Please continue on the EU-regulated website to ensure full regulatory protection.

Wednesday Dec 13 2023 13:15

7 min

European equities were firmer early Wednesday after a mixed session the day before. The FTSE 100 attempted to break higher from the 200-day SMA to test the 7,600 area again but pared gains, last trading up a third of percent for the session around 7,570. The Cac hit a record high yesterday, rising to 7,582 points in early session trading, which beat a previous intraday record high of 7,581.26 hit in April, before finishing weaker. It’s up almost half a percent close to the record again this morning as of pixel time. The Dax climbed a quarter of a point. US stocks rose for a fourth day with all three major indices touching fresh intraday YTD highs. Asia delivered a weak handover and early gains for Europe are not exactly overwhelming – FOMC ahead.

Oil prices tumbled more than 3% and are holding losses around $68, not far off the June lows (WTI front month futures @ $67) this morning amid signs of rising Russian exports and a pervading sense of oversupply as seen with the very shallow contango with Jan ’24 WTI trading only about a dollar or so below the Sep ’24 contract – watch if this deepens. Sugar (no11 futures) bounced off the late June lows at $0.22 at after being down 20% in two weeks - India discouraging producers diverting sugar to produce ethanol, which could help rebalance the market, whilst Ukraine imports rising Gold eased back further to sit just above its 50-day line at $1,970. Sterling nudged lower as the UK economy shrank in October, with GBPUSD to 1.2520 whilst the dollar was up a bit against the euro and yen also to regain some of yesterday’s lost ground. Yields danced around a bit as the US CPI inflation came in as expected, a tad lower than last month, but the 10yr Treasury remains anchored below 4.20% and 2yr holding onto 4.70%.

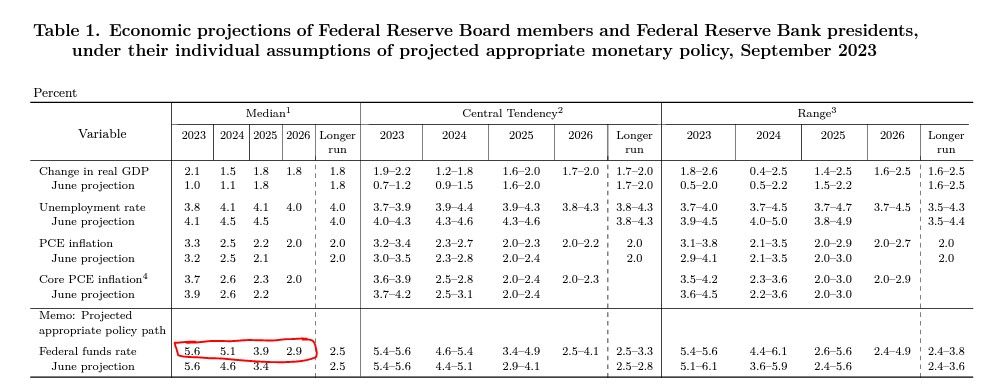

Assume dots to remain quite hawkish, but signs are the Fed will not push back 100% against the market pricing right now. It doesn’t want to knock itself into a corner with an overly hawkish message now that needs to be rolled back in a couple of months’ time. It also doesn’t want to throw its lot in with the market’s assumptions for aggressive and early rate cuts next year and unleash the market dogs. The 2023 dot should come down to 5.4% from 5.6%, with 2024 down to 4.9% from 5.1%, implying no shift in the projections for the number of cuts next year, albeit from a lower year-end level since the Fed is not following through with its last hike as indicated by the latest set of dots from September. Anything more than 50bps of implied cuts in 2024 would constitute a dovish message from the FOMC but I think the dots will imply 50bps less than the market has priced. For 2025, something like +100bps of cuts will still be pencilled in, with QT set to end in November 2024.

Economic forecasts are likely to be pretty much the same for 2024 – maybe inflation down a touch next year, GDP will need to be revised up for 2023. Unemployment is not rising and the Fed could indicate lower unemployment which is the ‘cover’ or excuse to maintain fairly restrictive policy.

The Fed can be feeling pretty good about inflation, but not crowing from the rooftops. Yesterday’s CPI was pretty much in line, down to 3.1% on the headline number and 4.0% for core. But the sticky H4L crowd can easily point to the flattery of the gasoline prices, used cars rose for the first time since May and the fact shelter is not coming down...the last mile is the hardest and Powel won’t be seeing much in the way of progress since November.But... inflation expectations have come down by some measures at least. NY Fed median one-year ahead inflation expectations declined to 3.4 percent, the lowest reading of the series since April 2021. This matters - as Powell put it earlier this year, "the modern belief is that people's expectations about inflation actually have a real effect on inflation. If you expect inflation to go up 5% then it will," he said. Or as the IMF puts it in more academic terms, “empirical analysis uncovers an increasing role of near-term inflation expectations for inflation dynamics”.

I think it’s still too soon to declare victory and this will be how the meeting is presented, I think. Speaking earlier this month Powell stressed that “it would be premature to conclude with confidence that we have achieved a sufficiently restrictive stance, or to speculate on when policy might ease”. This is likely how it goes this time too. And the Fed will be aware that we are into a lumpy patch as far the data goes – down one month and up the next...it’s plateauing.

Is there any narrative change from the last time Powell delivered remarks:

“The fact is, the Committee is not thinking about rate cuts right now at all,” Powell said at the last meeting. Minutes from the last meeting also indicated policymakers remain resolved to bring inflation down: “...participants continued to judge that it was critical that the stance of monetary policy be kept sufficiently restrictive to return inflation to the Committee’s 2 percent objective over time”. Of course the statement itself made plain the sense that the Fed thinks it has done enough: “In determining the extent of additional policy firming that may be appropriate to return inflation to 2 percent over time, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments.” And the minutes also showed some policymakers pointed to higher rates already biting: “Several participants noted that an increasing number of district businesses were reporting that higher interest rates were affecting their businesses or that firms were increasingly cutting or delaying their investment plans because of higher borrowing costs and tighter bank lending conditions.” BofA says the Fed will “take the initial steps in changing its communication from a hawkish hold to dovish one”.

Meanwhile Wolfe says Semis could have a strong year-end despite SOXX being up 56% this year.

Risk Warning and Disclaimer: This article represents only the author’s views and is for reference only. It does not constitute investment advice or financial guidance, nor does it represent the stance of the Markets.com platform. Trading Contracts for Difference (CFDs) involves high leverage and significant risks. Before making any trading decisions, we recommend consulting a professional financial advisor to assess your financial situation and risk tolerance. Any trading decisions based on this article are at your own risk.