Our company name has changed from Finalto International Ltd to Markets International Ltd.

What's staying the same?

There are no changes to your experience

If you have any questions, our support team is here to help via phone, Live Chat or email support@markets.com

You are attempting to access a website operated by an entity not regulated in the EU. Products and services on this website do not comply with EU laws or ESMA investor-protection standards.

As an EU resident, you cannot proceed to the offshore website.

Please continue on the EU-regulated website to ensure full regulatory protection.

Thursday Feb 8 2024 14:20

4 min

Early Thursday saw U.S. stock index futures showing minimal change, pointing to the S&P 500 opening just shy of its looming 5,000 milestone.

The financial markets saw gains on Wednesday, with the Dow Jones Industrial Average (DJIA) climbing by 156 points to 38,677, marking a 0.4% increase. The S&P 500 rose by 41 points to 4,995, a gain of 0.82%, while the Nasdaq Composite added 148 points, ending the day at 15,757, up by 0.95%.

Wall Street stands on the cusp of a significant breakthrough, with the S&P 500 nearing the record 5,000 mark for the first time, fueled by a wave of optimism surrounding corporate earnings — particularly from leading tech firms, such as Google-parent Alphabet, Amazon, and Meta Platforms.

This bullish sentiment is underpinned by a resilient U.S. economy and the market's adjustment to the expectation that interest rate cuts will begin later in the spring. CME Group’s FedWatch tool indicates that markets are currently pricing in an over 60% likelihood of the Federal Reserve cutting its benchmark interest rate in May, while the probability of the Fed cutting by June stands at over 95%.

Following a peak of 4,999.89 during Wednesday's trading and a record close of 4,995.06, Thursday's opening is expected to see the S&P 500 slightly lower at around 4,994, as per MarketWatch reporter Jamie Chisolm.

Сalculate your hypothetical P/L (aggregated cost and charges) if you had opened a trade today.

Market

Instrument

Account Type

Direction

Quantity

Amount must be equal or higher than

Amount should be less than

Amount should be a multiple of the minimum lots increment

USD

EUR

GBP

CAD

AUD

CHF

ZAR

MXN

JPY

Value

Commission

Spread

Leverage

Conversion Fee

Required Margin

Overnight Swaps

Past performance is not a reliable indicator of future results.

All positions on instruments denominated in a currency that is different from your account currency, will be subject to a conversion fee at the position exit as well.

The market mood was further bolstered by encouraging earnings from Walt Disney announced post-Wednesday's close, although this optimism is tempered by a less favorable earnings report from PayPal.

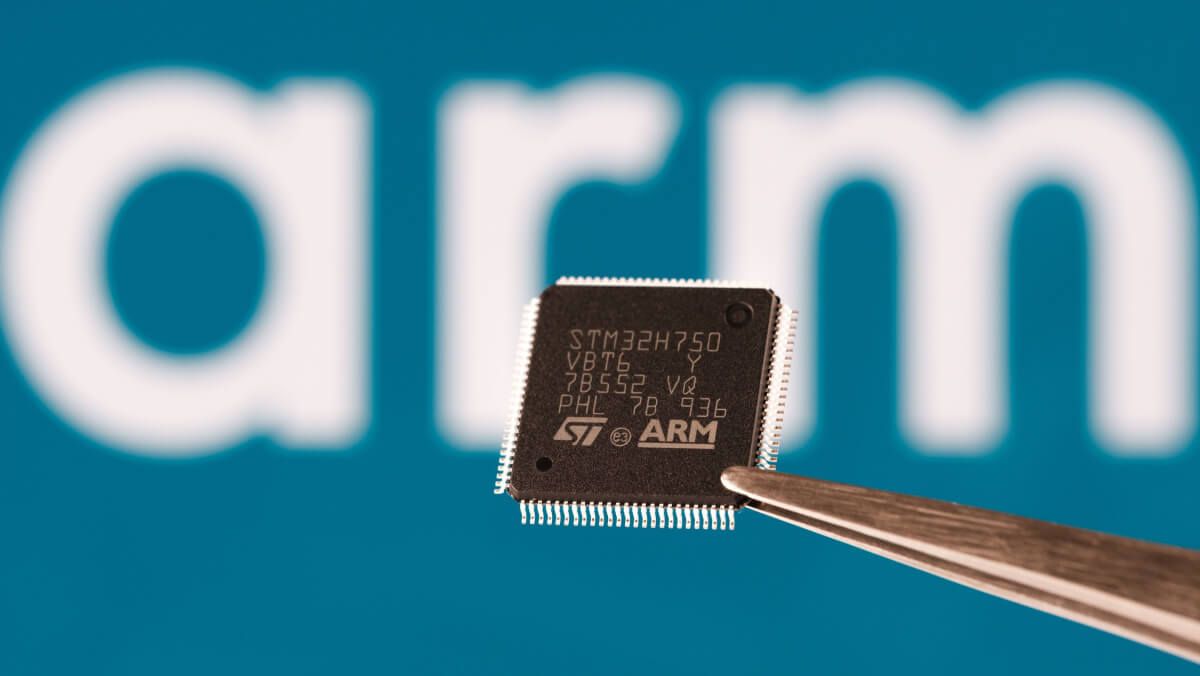

A key driver for both the S&P 500 and the Nasdaq Composite was the 20% surge in Arm Holdings shares, after the company delivered upbeat guidance and said it saw “increasing demand for new technology driven by all things AI.”

The 22.4% rally in the S&P 500 over the last year is largely attributed to the expectation that major tech corporations, like Microsoft and Nvidia, will benefit from AI advancements.

Kathleen Brooks, research director at XTB, said in a comment to MarketWatch:

“Overall, these earnings reports are likely to cheer the market. At the start of earnings season, a spate of poor reports from U.S. banks had weighed on earnings growth, however, now that the 10 other sectors have mostly reported earnings, the picture has brightened.”

Calmer conditions in the bond markets have also helped the S&P 500's upward trajectory. The U.S. Treasury's $42 billion auction of 10-year bonds on Wednesday saw strong demand, indicating that the market is more relaxed about inflation and the anticipated timeline for the Federal Reserve's first rate cut, now expected in May.

When considering shares and indices for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.

Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice.

Risk Warning and Disclaimer: This article represents only the author’s views and is for reference only. It does not constitute investment advice or financial guidance, nor does it represent the stance of the Markets.com platform. Trading Contracts for Difference (CFDs) involves high leverage and significant risks. Before making any trading decisions, we recommend consulting a professional financial advisor to assess your financial situation and risk tolerance. Any trading decisions based on this article are at your own risk.

Asset List

View Full ListLatest

View allSaturday, 18 October 2025

5 min

Saturday, 18 October 2025

5 min

Saturday, 18 October 2025

3 min