Our company name has changed from Finalto International Ltd to Markets International Ltd.

What's staying the same?

There are no changes to your experience

If you have any questions, our support team is here to help via phone, Live Chat or email support@markets.com

You are attempting to access a website operated by an entity not regulated in the EU. Products and services on this website do not comply with EU laws or ESMA investor-protection standards.

As an EU resident, you cannot proceed to the offshore website.

Please continue on the EU-regulated website to ensure full regulatory protection.

Friday Sep 29 2023 11:32

8 min

Stocks are managing to put a shine on a tough month and rally into the weekend despite Treasury yields spiking and European bond spreads widening yesterday. Yields have come off a bit as of this morning, along with the US dollar and oil, allowing stocks to make some further clawback, but the 10yr US Treasury note yield remains just a few bps off its highest in 16 years and crude is not far from a 13-month high scaled yesterday. The UK 10yr gilt yield spiked 0.2% before retracing a chunk of the move - its move exacerbated by the recent decline in yields as markets have been sharply revising peak rate expectations lower. Italian bond yields rose more than peers as the government raised its fiscal deficit, seeing the spread between BTPs and bunds widen to 200bps, the most since the March banking crisis. Across the board yields are at, or very close, to levels not seen since the financial crisis (US) or the sovereign debt crisis (Europe). Softer French inflation data this morning (CPI +4.9% vs +5.1% expected) is just dragging down European bond yields a bit more with the bund off 6bps to the US’s 3bps.

Why are long rates going up? You could say it’s that ‘higher for longer’ is hitting home but this is just a bit too simple: there are reasons why it’s hitting home. US government shutdown (Goldman says 90% likely now) and possible US debt downgrade, coupled with the ballooning budget deficit are factors. Italy meanwhile is signalling that budget deficits are rising – investors are starting to awaken to the fact that they are going to be bigger for longer. Huge issuance and Fed QT – retail is buying the bonds that the Fed is not...but demanding a much higher yield – they are far more discretionary than the automatic buying of the Fed. Japan is also a factor as it exits YCC – albeit slowly – and is mechanically pushing up global bond yields and investors are scrambling to be on the right side of it when it does pull the trigger on exiting negative rates. And then you chuck in the higher oil price just when inflation is supposed to be coming down and you get a situation where inflation worries flare up. So more issuance, bigger structural deficits and CBs are no longer mopping it all up: not good for bonds, nor for stocks.

Meanwhile, Evergrande, whose shares have been halted, released a statement to the HK Stock Exchange saying its executive chairman "has been subject to mandatory measures in accordance with the law due to suspicion of illegal crimes". China’s Beige Book showed weaker retail sales and house prices. Nike revenues fell short of expectations as sales dipped in North America.

Hong Kong jumped 3% as it rallied from a 10-month low, whilst mainland Chinese and South Korean stocks didn’t trade for the start of a week-long holiday. European stock markets traded higher again, erasing a fair chunk of the week’s losses. The Nasdaq rallied 0.83% to trade almost flat for the week, whilst the S&P 500 rose 0.6% and is down just 0.5% for the week, with futures pointing to a firmer open on Wall Street later. I think chiefly this is about a unclench reaction to lower oil, lower USD and lower yields today after a sharp move in all of those in recent days/weeks. Looking at the 200-day SMA on the S&P 500 at 4,210 – history suggests not great once this breaks.

Month and quarter end: FTSE 100 heads for a rally of about 2% in September (1% or so for the quarter) thanks chiefly to higher crude prices sending the oil majors up.; BP and Shell have rallied 10% through September as crude broke to its highest in a year this month. Elsewhere the seasonal weakness of September asserted itself once more – the S&P 500 and Nasdaq slipping around 5%, whilst the DAX and broader European equities ex-UK are down about 3%. The DAX has fallen about 4% in the quarter, but still +10% YTD, whilst the S&P 500 is roughly 3% lower in the quarter and +12% YTD. Bonds clearly blown up a bit this month and the dollar and oil have risen sharply once more. WTI +30% QTD is the best quarter since Q1 2022.

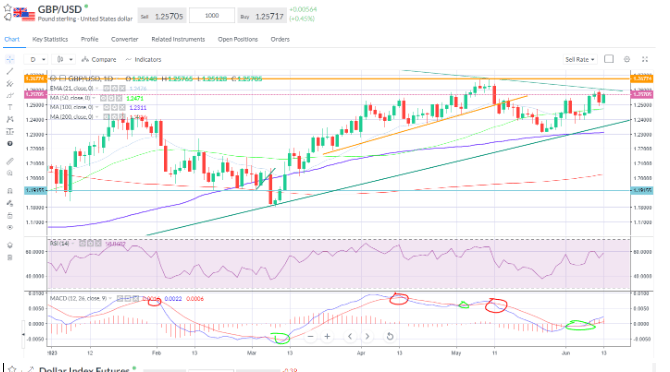

The dollar is up handsomely for the month but is in giveback mode today after sliding yesterday. Looks like another weekly gain but only just if it does. That has allowed EURUSD to recapture 1.06 having tested the 1.05 key support, whilst GBPUSD is back to the mid 1.22 area. Today the focus is on the US PCE inflation data and flash Eurozone CPI data.

WTI (Nov) - rejected the $95 level – highest since August last year - and pulled back – time for bulls to pause?

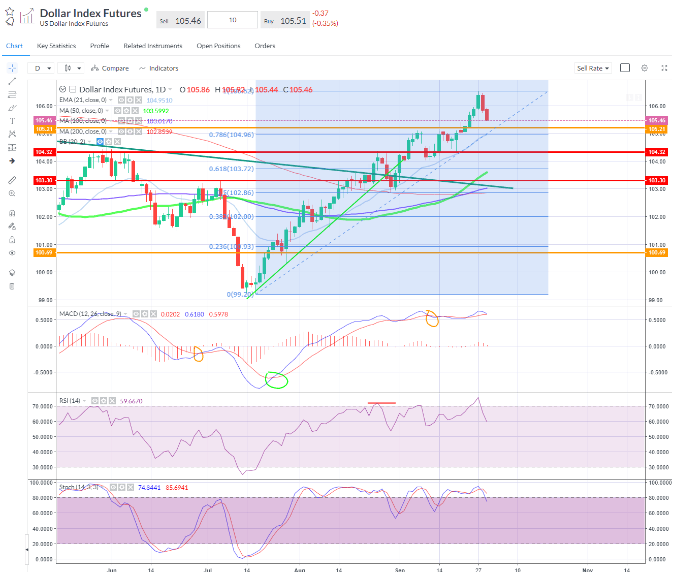

DXY – pulling back sharply in the last couple of sessions

Crude oil – Spot WTI towards the lower end of the range, finding some near-term support at $67, the May 31st low. OPEC monthly report coming up.

Risk Warning and Disclaimer: This article represents only the author’s views and is for reference only. It does not constitute investment advice or financial guidance, nor does it represent the stance of the Markets.com platform. Trading Contracts for Difference (CFDs) involves high leverage and significant risks. Before making any trading decisions, we recommend consulting a professional financial advisor to assess your financial situation and risk tolerance. Any trading decisions based on this article are at your own risk.