instrument_fundamentals

| date | Close | change | Change (%) | instr__open | High | Low |

|---|

instr__news

Day Trading Guide for February 04, 2026: Intraday supports, resistances for Nifty50 stocks

India's high credit-deposit ratio: Is the banking system overstretched or just efficient?

UJJIVAN SMALL FINANCE BANK Share Price Today Down 5%

New York State Common Retirement Fund Boosts Stake in HDFC Bank Limited $HDB

HDFC Bank Limited $HDB Stock Holdings Lifted by Veritas Asset Management LLP

New York State Common Retirement Fund Grows Holdings in HDFC Bank Limited $HDB - Daily Political

JK Tyre & Industries Ltd Stock Price: JK Tyre & Indust Share Price Today | India Infoline

HDFC Bank Limited $HDB Stock Position Lifted by Bank of New York Mellon Corp

HDFC Bank Limited $HDB Stake Raised by Aikya Investment Management Ltd

Donaldson Capital Management LLC Acquires New Shares in HDFC Bank Limited $HDB

Union Budget 2026: What corporate India expects from today's budget - HDFC Bank's Keki Mistry explains

Aikya Investment Management Ltd Boosts Stock Holdings in HDFC Bank Limited $HDB - Daily Political

February 2026 bank changes: These rules are changing as SBI, HDFC Bank, ICICI Bank and PNB revise charge

HDFC Bank Limited $HDB is Milestone Resources Group Ltd's 8th Largest Position - Markets Daily

Summit Global Investments Makes New Investment in HDFC Bank Limited $HDB

Channing Global Advisors LLC Buys 94,387 Shares of HDFC Bank Limited $HDB

55,791 Shares in HDFC Bank Limited $HDB Purchased by Summit Global Investments - Stock Observer

RIL shares weak, HDFC Bank rebounds, ICICI Bank slips - What are Anil Singhvi's key levels to watch?

ICICI Bank Ltd Stock Price: ICICI Bank Share Price Today | India Infoline

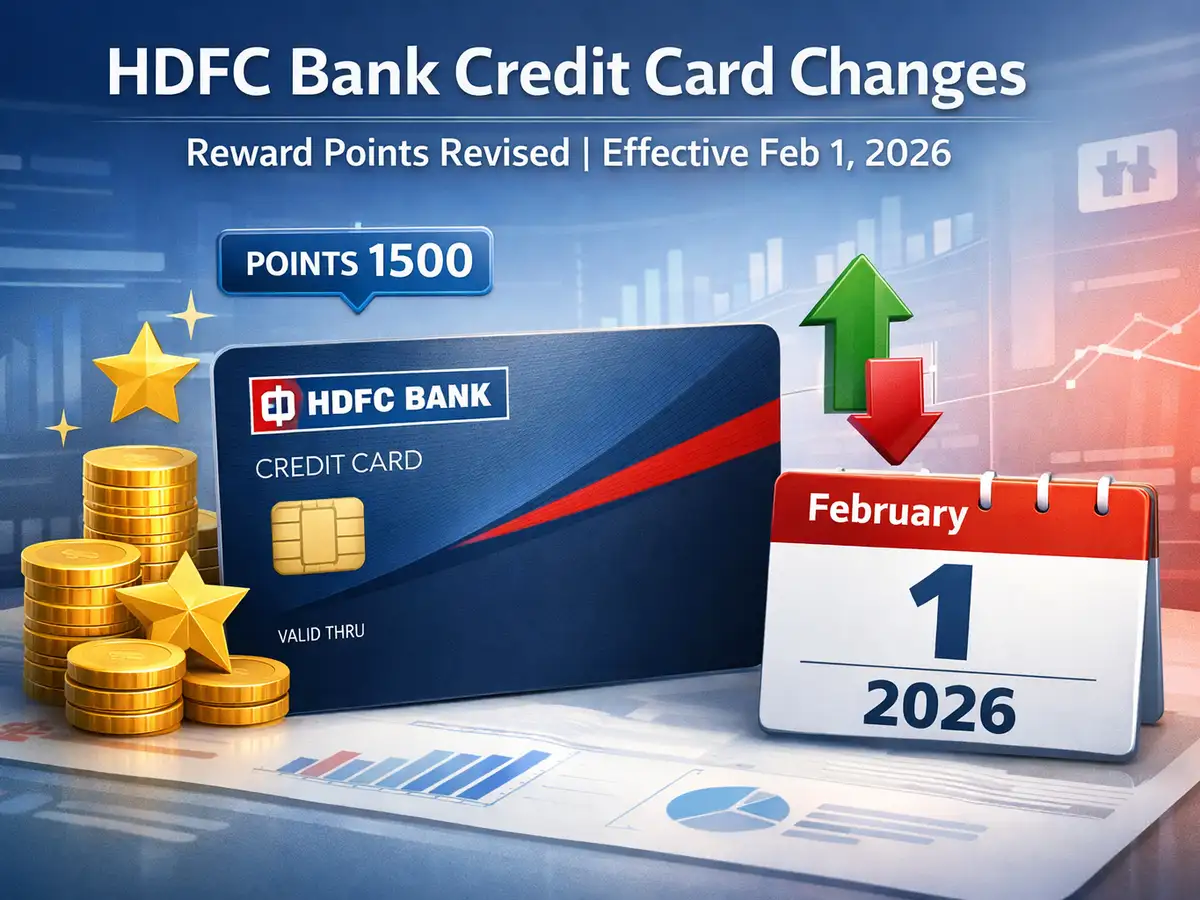

HDFC Bank to revise reward point criteria for this credit card from February 1, 2026: Check Apple, Tanishq, flight booking deals and more - The Economic Times

Day Trading Guide for January 30, 2026: Intraday supports, resistances for Nifty50 stocks

Banks at a crossroads: Rally or selloff on Budget Day?

HDFC Bank Limited $HDB Shares Purchased by Mirae Asset Global Investments Co. Ltd. - Daily Political

HDFC Bank Share Price Live Updates: HDFC Bank's six-month beta reflects stability - The Economic Times

Flossbach Von Storch SE Grows Stock Position in HDFC Bank Limited $HDB - Daily Political

Day Trading Guide for January 29, 2026: Intraday supports, resistances for Nifty50 stocks

SBI ELSS Tax Saver Fund Direct-Growth (₹ 479.72) - NAV, Reviews & Asset Allocation - The Economic Times

LIC MF Nifty 100 ETF -Growth (₹ 283.51) - NAV, Reviews & Asset Allocation - The Economic Times

What is Protective Call Option Trading Strategy? | IIFL Capital

Write-offs by Major Private Lenders Continue to Rise - The Economic Times

HDFC Capital partners with Curated Living Solutions to establish ₹1,000 crore rental housing platform | Real Estate News

HDFC Bank Limited $HDB Stock Position Lifted by Vanguard Personalized Indexing Management LLC

PNB, Union Bank, BoI see negative YoY growth in active debit cards in Dec '25

HDFC Bank Limited $HDB Shares Purchased by Kornitzer Capital Management Inc. KS - Markets Daily

What Makes HDFC Bank (HDB) a Worthy Investment?

Lbp Am Sa Buys 23,700 Shares of HDFC Bank Limited $HDB - Markets Daily

Vanguard Personalized Indexing Management LLC Has $5.34 Million Holdings in HDFC Bank Limited $HDB - Stock Observer

HDFC Bank Share Price Live Updates: HDFC Bank sees positive movement in stock price - The Economic Times

Day Trading Guide for January 28, 2026: Intraday supports, resistances for Nifty50 stocks

HDFC Bank Limited $HDB Shares Acquired by Nicola Wealth Management LTD. - Markets Daily

HDFC Bank Launches Parivartan Skilling Centre in Meerut in Partnership with Nasscom Foundation

SBI up over 7% in a month, briefly overtakes ICICI Bank in market-cap ranking after 6 years

Anil Singhvi's strategy for HDFC Bank shares: How to trade the stock in volatile markets?

Day Trading Guide for January 27, 2026: Intraday supports, resistances for Nifty50 stocks

Bandhan Large Cap Fund Direct-Growth (₹ 89.25) - NAV, Reviews & Asset Allocation - The Economic Times

Reliance Industries Ltd Stock Price: Reliance Industr Share Price Today | India Infoline

ICICI Prudential Large Cap Fund Direct-Growth (₹ 122.30) - NAV, Reviews & Asset Allocation - The Economic Times

CIBC Asset Management Inc Purchases 552,672 Shares of HDFC Bank Limited $HDB

Cabot Wealth Management Inc. Buys 283,520 Shares of HDFC Bank Limited $HDB

Value of CDs climbs to Rs 5.75 trn, rates cross 7% for marquee banks - Rediff.com Business

AEGON ASSET MANAGEMENT UK Plc Increases Stake in HDFC Bank Limited $HDB

HDFC Bank (NYSE:HDB) Upgraded at Wall Street Zen

Market cap of 9 of top-10 most valued firms plunges by Rs 2.51 lakh cr; RIL biggest laggard - The Economic Times

FACTORIAL MANAGEMENT Ltd Acquires New Holdings in HDFC Bank Limited $HDB

Baillie Gifford & Co. Buys 3,353,109 Shares of HDFC Bank Limited $HDB

Naples Global Advisors LLC Increases Stock Position in HDFC Bank Limited $HDB - Daily Political

Trio on scooty snatches cyclist's phone in Dhanas

Anil Singhvi's Stock Market Radar: Why HDFC Bank looks ready for a comeback while RIL, ICICI Bank stay under pressure

HDFC Bank Share Price Live Updates: HDFC Bank faces a tough month with negative returns - The Economic Times

Day Trading Guide for January 23, 2026: Intraday supports, resistances for Nifty50 stocks

HDFC Bank (NYSE:HDB) Releases Earnings Results, Beats Expectations By $0.04 EPS - Markets Daily

Hudson Edge Investment Partners Inc. Boosts Stock Position in HDFC Bank Limited $HDB - Markets Daily

Critical Comparison: HDFC Bank (NYSE:HDB) & CaixaBank (OTCMKTS:CAIXY) - Markets Daily

HDFC Bank sheds over Rs 1 lakh crore in a month - Should you buy now? Anil Singhvi explains

SilverBeES, GoldBeES log higher one-day trading volumes than HDFC Bank, ICICI Bank - The Economic Times

Paytm: Public Sector Banks Embrace QR Payments to Compete with Fintech Giants, ETBFSI

Auto Retail Finance: Finance and Insurance Revolutionizing the Auto Retail Landscape, ETAuto

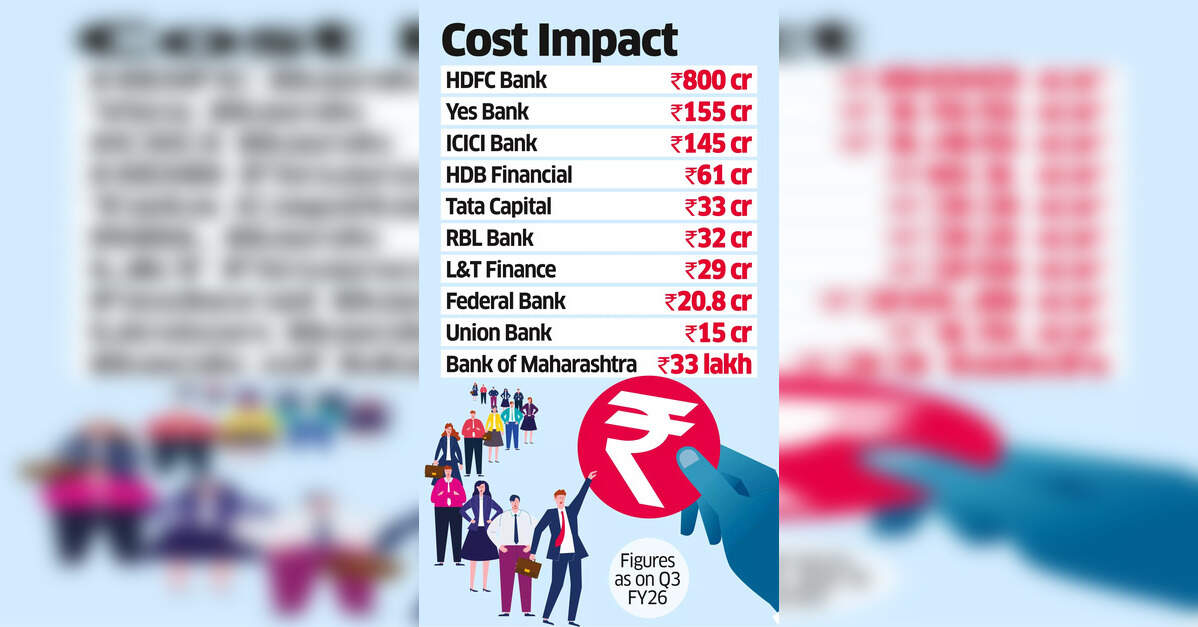

Tata Capital: Biggest labour reforms cost Rs 1,500 crore to HDFC & peers, ETHRWorld

Day Trading Guide for January 22, 2026: Intraday supports, resistances for Nifty50 stocks

Zerodha Nifty 50 ETF - Growth (₹ 10.06) - NAV, Reviews & Asset Allocation - The Economic Times

Kotak Nifty Bank ETF-IDCW (₹ 612.18) - NAV, Reviews & Asset Allocation - The Economic Times

Cybercrooks exploit Aadhaar-sim link to siphon money

PSU banks counting on QR-based payments to breach a fintech fort - The Economic Times

How an agri-loans discrepancy has hurt India's Top 3 private banks

Sequoia Financial Advisors LLC Boosts Stock Holdings in HDFC Bank Limited $HDB

HDFC Bank (NYSE:HDB) Posts Quarterly Earnings Results - Stock Observer

Buy HDFC Bank; target of Rs 1175: Motilal Oswal

HDFC Bank (HDB) Projected to Post Quarterly Earnings on Wednesday

HDFC Bank (NYSE:HDB) Releases Earnings Results, Beats Estimates By $0.04 EPS - Daily Political

HDFC Bank Share Price Live Updates: HDFC Bank's 3-Month Performance Overview - The Economic Times

RBI approves appointment of Kaizad Bharucha as whole-time director in HDFC Bank

Top stocks in news: HDFC Bank, Amagi Labs, HCL Tech, USL, Tata Steel, AU Bank, Power Grid

Day Trading Guide for January 21, 2025: Intraday supports, resistances for Nifty50 stocks

ICICI Prudential BSE 500 ETF - Growth (₹ 38.54) - NAV, Reviews & Asset Allocation - The Economic Times

Kaizad Bharucha Reappointed as HDFC Bank Deputy MD - The Economic Times

NBFCs poised to outperform in easing rate cycle: Sandip Sabharwal, ETBFSI

HDFC Bank's forced balancing act drags stock 6%, makes it Nifty Bank's biggest laggard. What to do? - The Economic Times

HDFC Bank expects healthy loan growth, stable margins, robust asset quality in FY27

Kotak Mahindra AMC, Aequitas among top 10 equity PMS performers in 2025. Full list here

HDFC Bank, ICICI Bank, RIL, REC in your portfolio? Anil Singhvi explains what to do

HDFC Bank Ltd (HDB) Q3 2026 Earnings Call Highlights: Strong Profit Growth Amid Liquidity Challenges

Day Trading Guide for January 20, 2025: Intraday supports, resistances for Nifty50 stocks

Nippon India ETF Nifty 100-IDCW (₹ 272.32) - NAV, Reviews & Asset Allocation - The Economic Times

Mirae Asset Nifty Financial Services ETF - Growth (₹ 28.09) - NAV, Reviews & Asset Allocation - The Economic Times