Gumagamit kami ng cookies para malaman ang mga content o feature na maaring interesado kang gamiting katulad ng live chat. Kung ikaw ay sumasang-ayon sa pag-gamit nito, i-click ang accept.

You are attempting to access a website operated by an entity not regulated in the EU. Products and services on this website do not comply with EU laws or ESMA investor-protection standards.

As an EU resident, you cannot proceed to the offshore website.

Please continue on the EU-regulated website to ensure full regulatory protection.

Miyerkules Sep 18 2024 10:36

4 min

It’s Fed Day. There will be lots of takes and noise about the decision. Whether it’s a cut of 25 or 50 basis points matters little – the signal on the neutral rate and how fast the Federal Reserve thinks it needs to get there will be important. And also, the landing – the Fed thinks it has room to move slowly – i.e. maintaining a degree of restriction for longer — but the worm may have already turned.

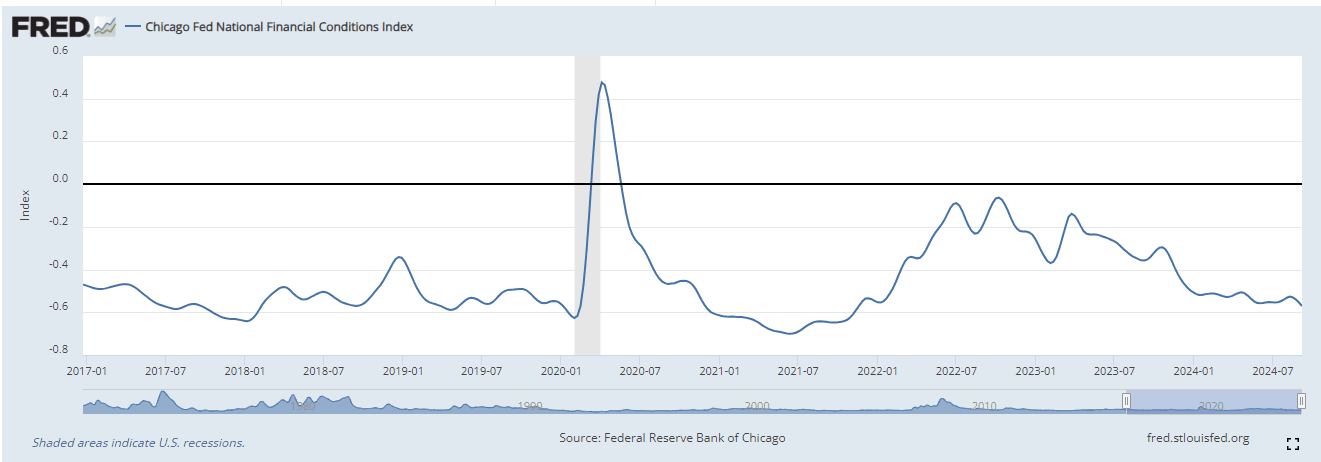

I still favour 25bps over 50bps as a prediction (not a recommendation) — it gives them room to cut interest rates aggressively after the election and avoid being tarred with political interference. And with the market at an all-time high, it’s hard to argue that financial conditions are overly restrictive. With the market pricing in a fair few cuts in the coming months, financial conditions remain accommodative and can stay that way with 25bps.

As another sign of financial conditions not being overly restrictive – the Chicago Fed index is at its loosest since Jan. 2022.

Policy mistake? Some might would argue it’s already too late and that the Federal Reserve has already made a huge policy error. Yesterday the 2-year Treasury rate was 3.56%, while the Fed funds rate was 5.33%, resulting in a spread of -1.77 percentage points, which is the widest it’s been since 1988.

Investors are not concerned – the BofA Global Fund Manager Survey reports sentiment improving on ‘Fed cuts + soft landing’ optimism... you get both? It also notes that nine in ten see a steeper yield curve whilst investors have tactically switched to bond proxies in September from cyclicals — but cyclicals are the biggest beneficiaries of rate cuts.

The S&P 500 ended almost after hitting a record high on Tuesday. European stock markets are mixed this morning with all eyes clearly on the Fed. The dollar came back yesterday after hitting its weakest in over a year, but gains are limited for now.

I-calculate ang iyong hypothetical P/L (aggregated cost at charges) kung ikaw ay nag-open ng trade ngayong araw.

Market

Instrument

Account Type

Direksyon

Dami

Ang halaga ay dapat katumbas o mas mataas sa

Ang halaga ay dapat mas mababa sa

Ang halaga ay dapat multiple ng minimum lots increment

USD

EUR

GBP

CAD

AUD

CHF

ZAR

MXN

JPY

Value

Komisyon

Spread

Leverage

Conversion Fee

Required Margin

Ang pagdamagang Palitan

Ang nakalipas na pagsasagawa ay hindi maaasahang tagapaghiwatig ng mga paparating ng mga resulta

Ang lahat ng mga position ng mga instrumenton ng denominasyon sa isang salapi na iba sa pananalapi ng iyong account, ay sasailalim din sa bayad sa conversion sa paglabas ng posisyon.

UK inflation was steady at 2.2% ahead of tomorrow’s Bank of England meeting – always the bridesmaid. The worry for the MPC is sticky services inflation — up to 5.6% from 5.5% the month before. And core inflation rose to 3.6% in August from 3.3% in July. The BoE was expected to pause rate cuts tomorrow and the inflation figures tend to support this view. Markets suggest a one-in-four chance of a cut. The Fed should not have an impact as the MPC meets today and makes its announcement tomorrow.

The pound rose on the inflation figures. Short-term positive MACD crossover for GBPUSD with the rally off the CPI print at 7 a.m. seen clearly. Resistance at 1.320 but could push up to 1.3230 this morning and then bulls should look beyond to 1.3266 – the recent 2-year peak – should the Federal Reserve go big with a 50bps cut and sound dovish.

When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.

Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice.

Risk Warning and Disclaimer: This article represents only the author’s views and is for reference only. It does not constitute investment advice or financial guidance, nor does it represent the stance of the Markets.com platform. Trading Contracts for Difference (CFDs) involves high leverage and significant risks. Before making any trading decisions, we recommend consulting a professional financial advisor to assess your financial situation and risk tolerance. Any trading decisions based on this article are at your own risk.

Lista ng Asset

Tingnan ang Kabubuang ListaPinakabago

Tingnan ang lahatSabado, 18 Oktubre 2025

5 min

Sabado, 18 Oktubre 2025

5 min

Sabado, 18 Oktubre 2025

3 min