Kami menggunakan kuki untuk melakukan beberapa perkara seperti menawarkan sokongan sembang langsung dan menunjukkan kepada anda kandungan yang kami rasa anda akan minati. Jika anda bersetuju dengan penggunaan kuki oleh markets.com, klik terima.

You are attempting to access a website operated by an entity not regulated in the EU. Products and services on this website do not comply with EU laws or ESMA investor-protection standards.

As an EU resident, you cannot proceed to the offshore website.

Please continue on the EU-regulated website to ensure full regulatory protection.

Rabu Sep 18 2024 10:36

4 min.

It’s Fed Day. There will be lots of takes and noise about the decision. Whether it’s a cut of 25 or 50 basis points matters little – the signal on the neutral rate and how fast the Federal Reserve thinks it needs to get there will be important. And also, the landing – the Fed thinks it has room to move slowly – i.e. maintaining a degree of restriction for longer — but the worm may have already turned.

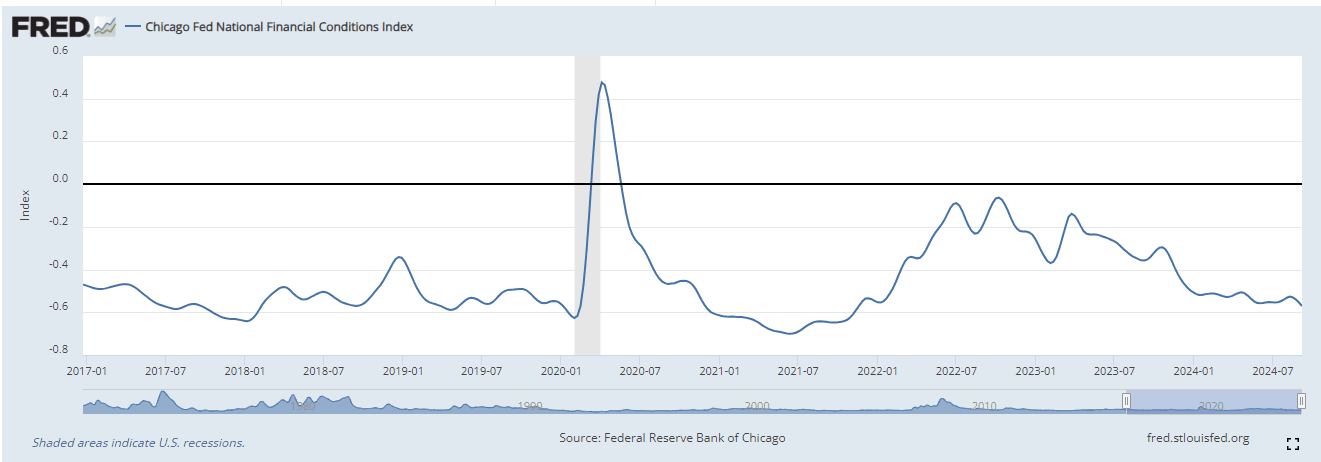

I still favour 25bps over 50bps as a prediction (not a recommendation) — it gives them room to cut interest rates aggressively after the election and avoid being tarred with political interference. And with the market at an all-time high, it’s hard to argue that financial conditions are overly restrictive. With the market pricing in a fair few cuts in the coming months, financial conditions remain accommodative and can stay that way with 25bps.

As another sign of financial conditions not being overly restrictive – the Chicago Fed index is at its loosest since Jan. 2022.

Policy mistake? Some might would argue it’s already too late and that the Federal Reserve has already made a huge policy error. Yesterday the 2-year Treasury rate was 3.56%, while the Fed funds rate was 5.33%, resulting in a spread of -1.77 percentage points, which is the widest it’s been since 1988.

Investors are not concerned – the BofA Global Fund Manager Survey reports sentiment improving on ‘Fed cuts + soft landing’ optimism... you get both? It also notes that nine in ten see a steeper yield curve whilst investors have tactically switched to bond proxies in September from cyclicals — but cyclicals are the biggest beneficiaries of rate cuts.

The S&P 500 ended almost after hitting a record high on Tuesday. European stock markets are mixed this morning with all eyes clearly on the Fed. The dollar came back yesterday after hitting its weakest in over a year, but gains are limited for now.

Kira P/L andaian anda (kos dan caj teragregat) jika anda membuka perdagangan hari ini.

Pasaran

Instrumen

Jenis Akaun

Arah

Kuantiti

Amaun mestilah sama dengan atau lebih tinggi daripada

Amaun hendaklah kurang daripada

Amaun hendaklah gandaan kenaikan minimum lot

USD

EUR

GBP

CAD

AUD

CHF

ZAR

MXN

JPY

Nilai

Komisen

Sebaran nilai

Leveraj

Yuran Penukaran

Margin Diperlukan

Pertukaran Semalaman

Prestasi masa lalu bukan petunjuk yang boleh dipercayai tentang hasil masa hadapan.

Semua kedudukan pada instrumen yang berdenominasi dalam mata wang yang berbeza daripada mata wang akaun anda adalah tertakluk kepada yuran penukaran pada keluar kedudukan juga.

UK inflation was steady at 2.2% ahead of tomorrow’s Bank of England meeting – always the bridesmaid. The worry for the MPC is sticky services inflation — up to 5.6% from 5.5% the month before. And core inflation rose to 3.6% in August from 3.3% in July. The BoE was expected to pause rate cuts tomorrow and the inflation figures tend to support this view. Markets suggest a one-in-four chance of a cut. The Fed should not have an impact as the MPC meets today and makes its announcement tomorrow.

The pound rose on the inflation figures. Short-term positive MACD crossover for GBPUSD with the rally off the CPI print at 7 a.m. seen clearly. Resistance at 1.320 but could push up to 1.3230 this morning and then bulls should look beyond to 1.3266 – the recent 2-year peak – should the Federal Reserve go big with a 50bps cut and sound dovish.

When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.

Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice.

Risk Warning and Disclaimer: This article represents only the author’s views and is for reference only. It does not constitute investment advice or financial guidance, nor does it represent the stance of the Markets.com platform. Trading Contracts for Difference (CFDs) involves high leverage and significant risks. Before making any trading decisions, we recommend consulting a professional financial advisor to assess your financial situation and risk tolerance. Any trading decisions based on this article are at your own risk.

Senarai Aset

Lihat Senarai PenuhTerkini

Lihat semuaSabtu, 18 Oktober 2025

5 min.

Sabtu, 18 Oktober 2025

5 min.

Sabtu, 18 Oktober 2025

3 min.