CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76.3% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Here at markets.com we are firm believers that trading should be accessible to everyone. Here are some basics of trading you need to know to help get you started on your trading journey.

Financial trading involves the buying and selling of securities such as stocks, currencies, commodities, bonds and even cryptocurrencies. Unlike traditional buy-and-hold investing, CFD trading can be as short-term as you like, with trades lasting anything from weeks to just a few seconds.

A CFD stands for Contract-for-Difference, which is a type of derivative. A CFD is a contract between a broker and trader to exchange the difference in value of the security between the start of the contract – when you open the position – and the end of the contract; when you close the position.

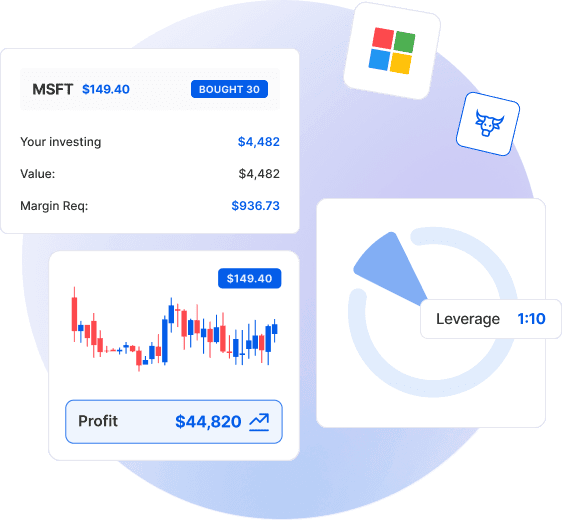

With CFDs you do not need to own the underlying asset and enable you to profit whether an asset is rising or falling. Simply open a long (buy) or short (sell) position depending on whether you think the price of the underlying asset will rise or fall. CFD trading involves the use of leverage, enabling traders to open larger positions. However, it is important to note that this is a double-edged sword - magnifying the potential for both profits and losses.

Leverage enables traders to control larger positions with a smaller initial outlay. Essentially you put down a deposit with the broker, called margin, which is a fraction of the actual trade size. The more leverage you have, the bigger positions you can take, and the bigger your swings of profit and loss can be. Leverage magnifies losses as well as profits, so needs to be treated with caution.

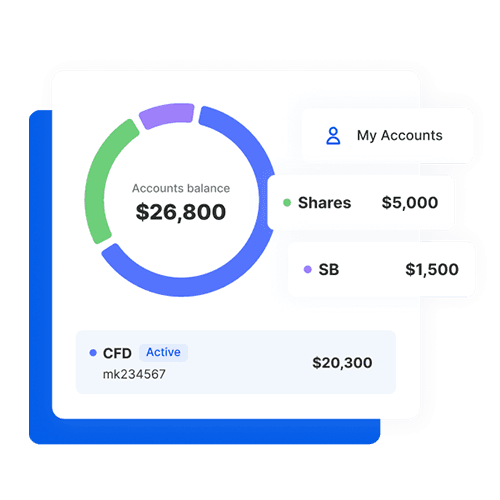

A variety of assets are available for trading with CFDs. At markets.com you can trade on shares, indices, ETFS, currencies, commodities, bonds and cryptocurrencies. Currency trading, often referred to as forex, or foreign exchange, trading is among the most popular ways to trade online. This can all be done using a single multi-asset platform with a single currency account.

Trading is inherently risky. markets can rise and fall and no one can predict the future with certainty. However, there are ways to mitigate risks.

For instance, a sound risk management strategy starts by carefully analysing the markets, applying position sizing that is appropriate to your financial situation (not staking too much on one trade), and using platform tools such as stop-loss orders and take-profit orders to minimise drawdowns and maximise potential profits.

Emotions can affect our decisions, so it is important to learn how certain biases and feelings can impact our trading habits. Trading psychology refers to your ability to handle risks and deal with gains and losses in an appropriate manner. If you understand the risks and learn how to master trading psychology, you will have an easier time keeping your head and executing transactions strategically. Find out more about understanding the Psychology of Trading with our in depth guide.

Easy as 1,2,3

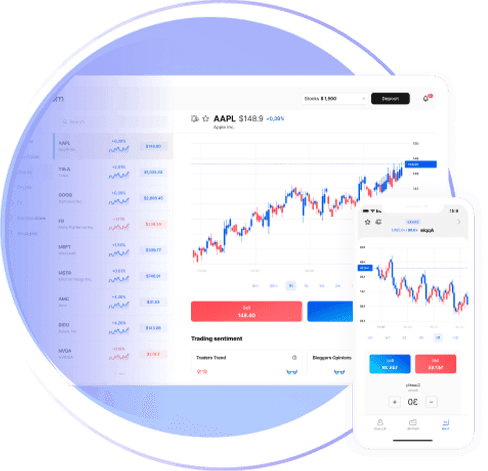

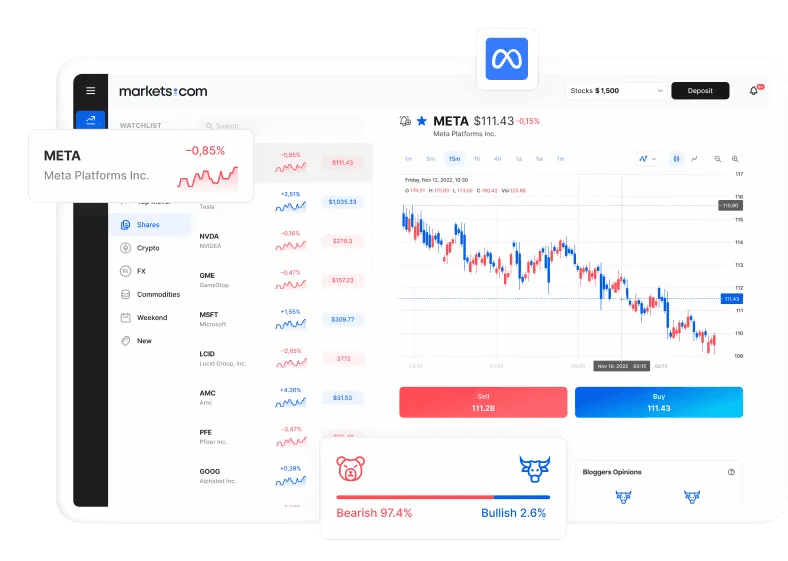

First you need to open an account with markets.com, and either download the app or use the desktop version.

Opening an account is simple; just provide us with a few details so we can do our checks, answer some questions about trading to check you are suitable for leveraged products, and then deposit funds.

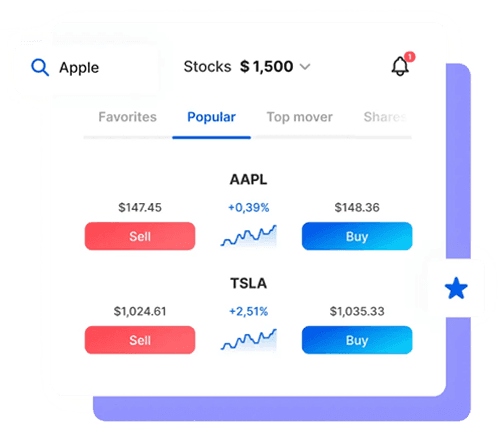

Select an asset you’d like to trade, for instance Apple CFD shares. Type the name into the search bar, or look for it in the shares list, and find out more about the price history and other useful information like financials and what analysts are saying about the stock.

Then open a deal ticket and choose whether to go long (buy) or short (sell). Decide how much you’d like to stake and think about adding stop-loss orders and/or take-profit orders.

Always think about your time horizon – how long do you want the trade to last, and how much drawdown (paper loss) are you willing to absorb.

With a WTI CFD, you would be trading on the price movements of a minimum of 10 units of WTI oil (i.e., ten barrels). If the oil price is $60 per barrel, your exposure would be $600 (10 x 60).

In this example, the oil futures trade work on 10% leverage as standard, so your initial margin would be $60 (10% of $600).

If the price of oil rises by $1, you would then make 10 x $1, so you would come out with $10 of profit. However, if the price fell by $1, you would lose 10 x $1, and take an $10 loss, because you are trading on margin.